multistate tax commission members

Establishes a commission whose purposes are 1 to facilitate proper determination of state and local tax liability of multistate taxpayers 2 to promote uniformity and compatibility in significant components of tax systems 3 to facilitate taxpayer convenience and compliance 4 seeks to avoid duplicate taxation 5 conducts audits of major corporations on behalf of. New Jersey Tax Court Holds that Individual S Corp Shareholders Cant Claim Credit for Certain Taxes Paid to Another State.

Multistate Tax Commission Home

MEMBERS OF BBB NATP.

. 86-272 income tax immunity. Dennis Daugaard R signed legislation withdrawing his state from the Multistate Tax Commission MTC. Multistate Tax Commission 444 North Capitol Street NW Suite 425 Washington DC 20001 Phone.

On February 28 South Dakota Gov. In addition 70 of the members surveyed indicated that confidential information. Get a brief overview of Multistate Tax and see our current team of knowledgeable and dedicated employees.

Brian Hamer Hearing Officer Multistate Tax Commission. Deputy General Counsel Lila Disque. Seven states are sovereignty members.

Zacarias Quezada a manager with Marcum LLP provides an overview of the limitations of the law and what it means for businesses. The Procedures of Multistate Voluntary Disclosure govern the NNP staff and member states during the process. Gregory Matson Executive Director Multistate Tax Commission Ms.

444 North Capitol Street NW Suite 425. A To assist in the conduct of its business when the full Commission is not meeting the Commission shall have an Executive Committee of seven members including the Chairman Vice Chairman Treasurer and four other members elected annually by the Commission. NOTE TO TAXPAYERS IN WHICH THE MTC HAS FILED A BRIEF AGAINST YOU - YOUR CHANCES OF WINNING.

In 1986 the MTC adopted the Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 which sets forth the MTC signatory states interpretation of those in-state activities that are conducted by or on behalf of a corporation and fall within or outside the protection of PL. New Law Directs State to Join Multistate Tax Commission as an Associate Member IncomeFranchise California FTB Provides Updated Preliminary Report to Legislature on 2017 Federal Tax Reforms Florida. NNP staff can explain those more fully if applicable.

81718In a case involving New Jerseys gross income tax ie personal income tax the New Jersey Tax Court Court recently granted summary judgment in favor of the New Jersey Division of. Deputy Executive Director Scott Pattison. Are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law.

Helen Hecht General Counsel Multistate Tax Commission Ms. General Counsel Nancy Prosser. The Multistate Tax Commission MTC is an interstate instrumentality located in the United States.

Twenty-six states are associate members. Rest easy knowing your taxes will be properly handled every single year with the help from the experienced team at Multistate Tax Inc. Multistate Tax Commissions recent update to Public Law 86-272 interpretation recent transfer-pricing audit activity and an update to the states taxation of digital commerce.

Two states are nonmembers. Lila Disque Deputy General Counsel Multistate Tax Commission Mr. He has been trained by both the Internal Revenue Service and the Multistate Tax Commission in the areas of income tax and multistate entity tax compliance.

Examples include if you are undergoing an audit or are curious about the history of the Multistate Tax Compact or Multistate Tax Commission. Joe Huddleston Executive Director Multistate Tax Commission Date. Fifteen states and the District of Columbia are members of the Multistate Tax Compact.

DTTL and each of its member firms are legally separate and. South Dakotas move follows similar legislation signed by California Gov. It is the executive agency charged with administering the Multistate Tax Compact 1967.

Sovereignty members are states that support the purposes of the Multistate. Compact membersare states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law. For further information please contact.

86-272 which deals with net income tax including a new section on businesses that interact with customers online and make digital sales. South Dakota Utah Joining Rush for the Exits at the Multistate Tax Commission. May 14 2009 Subject.

Commission members acting together attempt to promote uniformity in state tax laws. The Multistate Tax Commission MTC is set to revamp its transfer pricing collaboration and enforcement initiatives following the first public meeting of its State. Uniformity Counsel Helen Hecht.

If you have questions about the activities of the Muttistate Tax Commission we are available to consult with you. This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL. Director of Administration William Six.

These states govern the Commission and participate in a wide range of projects and programs. Examining New York States Business and Banking Tax Structures Chairperson Krueger and members of the Select Committee thank you very much for. New Law Updates State Conformity to IRC Extends Bonus Depreciation Decoupling and Includes Contingent Corporate Income Tax Rate.

As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. A To assist in the conduct of its business when the full Commission is not meeting the Commission shall have an Executive Committee of seven members including the Chairman. Executive Director Gregory S.

The Multistate Tax Commission MTC was created by the Multistate Tax Compact and is charged with facilitating the proper determination of State and local tax liability of multistate taxpayers There are currently 16 Compact Members including Colorado Texas Washington and the District of Columbia and 26 AssociateProject members. Prior to going into private practice Spencer was a tax auditor specializing in multistate pass-through entities successfully completing over 4000 audits. The Multistate Tax Commission MTC recently updated its guidance on PL.

The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co. Senator Liz Krueger Chair and Members of the Select Committee on Budget and Tax Reform From. The Multistate Tax Commission MTC is set to revamp its transfer pricing collaboration and enforcement initiatives following the first public meeting of its State Intercompany Transactions Advisory Service SITAS Committee in over four years.

Have not adopted the compact but pledged support for the activities of the Multistate Tax Commission. Multistate Tax Commission June 13 2018 Page 3 of 10. Company limited by guarantee DTTL its network of member firms and their related entities.

These states govern the Commission and participate in a wide range of projects and programs.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Multistate Tax Commission With Helen Hecht Taxops

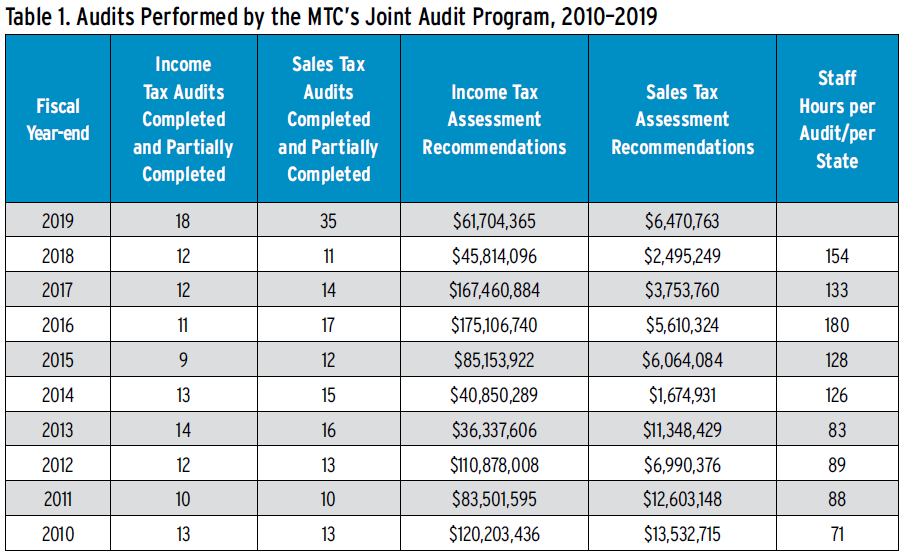

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

.jpg.aspx)

Multistate Tax Commission News

Uniformity Committee Memo Multistate Tax Commission

The Powers Of Congress Topic Ppt Download

Uniformity Committee Memo Multistate Tax Commission

Tax Executives Institute State Local Tax Update St Louis Missouri January 30 Ppt Download

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

The Mtc Adopts New Guidance To Address Online Business Crowe Llp

.jpg.aspx?lang=en-US?width=250&height=306)

Multistate Tax Commission News

Multistate Tax Commission News

Multistate Tax Commission Home

Uniformity Committee Memo Multistate Tax Commission

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive